You can use Mobile Check Deposit for HSA and most Fidelity brokerage accounts and IRAs. Your eligible accounts are listed in the account selection menu on the 'Deposit a Check' screen. Mobile check deposit lets you deposit checks into your U.S. Bank account using the camera on your mobile device. Here’s how it works: Sign your check. Choose an account. Enter your check amount. Take photos of the front and back. Review and submit. See mobile check deposit. Mobile banking apps with the Mobile Deposit feature can save you a trip to the bank and allow you to deposit checks whenever is most convenient for you. Just take a picture of the front and back of the check and upload! Sign the back of your check and write “For Mobile Deposit at Wells Fargo Bank Only” below your signature (or if available, check the box that reads: “Check here if mobile deposit”). Take a photo of the front and back of your endorsed check.

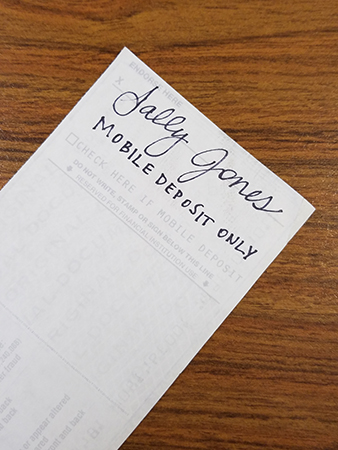

For Mobile Deposit Only Example Picture

For Mobile Deposit Only Stamp

- Can I view a copy of my check after it has been deposited?

Yes, select “View mobile deposit history” to view the front and back of a check image that was submitted within the last 30 days. If you need to see a check image that is outside of the 30 days, please contact Member Services at 1-800-645-4728.

- What are the deposit limits?

$15,000.00 limit per deposit with a $15,000.00 limit per day.

- Do I need to endorse the check I am depositing?

Yes. You must endorse your check as follows: 'For Mobile Deposit Only' and your signature.

- When will the funds be deposited and available within my account?

Funds will be deposited into your account within two (2) business days and will follow GSCU's regular funds availability schedule. Please refer to our Funds Availability Disclosure.

- What types of check deposits are NOT accepted through Mobile Deposit?

1) Any item that is stamped with a 'non-negotiable' watermark.

2) Any item that contains evidence of alteration to the information on the check.

3) Any item issued by a financial institution in a foreign country.

4) Any item that is incomplete.

5) Any item that is 'stale dated'* or 'post dated'**.

6) Savings Bonds.

7) Third party checks***.

*Stale dated checks are defined as any check that is being negotiated more than six months after the date on the check.

**Post dated checks are defined as any check that is deposited before the date on the check.

***Third party checks are defined as checks that have been transferred by the original payee to a third party by means of an endorsement. - Will I be notified if my check is not accepted or if it is rejected?

Yes, our eServices department will notify you via email.

If your check is rejected you can visit any one of our convenient locations to deposit the check. You can also mail your deposit to:

Granite State Credit Union

PO Box 6420

Manchester, NH 03108 - What is Mobile Deposit?

Mobile Deposit allows members to deposit checks utilizing their smartphone or tablet devices. You can deposit money in all of your GSCU share accounts.

- Who do I contact if I encounter an issue?

Please contact a Member Services Representative at 1-800-645-4728 or send an email to eservices@gscu.org.

- What do I do with the physical check once it has been deposited?

The physical check should be retained in a secure location for a period of ninety (90) days. After this period expires you can destroy the check.